Not known Incorrect Statements About Group Coverage Basics

The Facts About Florida Health Care Plans: Health Insurance Plans Revealed

When you select United, Health care, you'll get group advantage services created to deliver more health care value for your service and your employees. Notified by the most robust data and insights in the industry, United, Health care strategies are constructed to reduce your overall cost of care, enhance care quality for your staff members, champion health and wellness for much better outcomes, and simplify the healthcare experience for everyone.

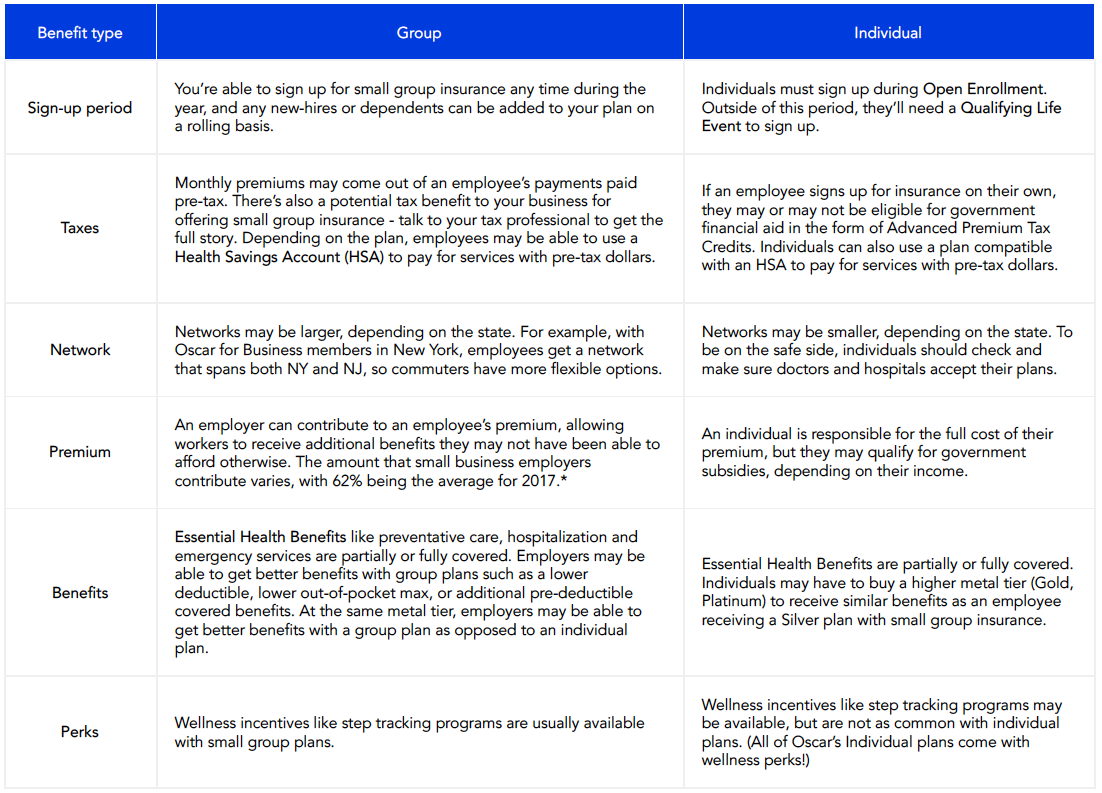

Group medical insurance is a type of medical insurance policyfor staff members or members of a business or company. I Found This Interesting offers medical insurance protection to its members at a lowercost considering that the danger to health insurance companies is spread across the members of thegroup health insurance. Businesses and companies buy group health insurance coverage strategies in order to provide medical protection to their employees or members.

Getting My Health care coverage guide - Texas Department of Insurance To Work

Although all group medical insurance plans are different due to variations in costs, health insurance companies, group plan types, and strategy specifications, they usually share the following qualities: Group medical insurance plans typically need a 70 percent involvement rate Group members have the option of registering in or declining health protection Group health premiums are shared between the business and its employees Family members and dependents can be included to group strategies at extra expense To enlist in a group medical insurance strategy, a service requires a minimum of one full-time or full-time comparable staff member.

Essential Group Health insurance - LinkedIn

The main benefit of group medical insurance coverage is that groupplans tend to have relatively low premiums. Due to the benefit of bigger riskpools, group medical insurance plans are often more economical than individualhealth plans. When more people enlist in a group medical insurance coverage strategy, thisspreads risk throughout a larger number of plan members in the group swimming pool, allowingthe high insurance cost of any one individual to be balanced by the premiumspaid by other members of the strategy.

Group Health Insurance

The Best Strategy To Use For Group Insurance Commission (GIC) - Mass.gov

For an employer, the money paid toward month-to-month staff member premiums is generally tax-deductible For staff members, premiums are paid with pre-tax dollars, which can lower their taxable income Eligible small companies might be able to receive the small service health care tax credit Organizations and organizations can enroll in group medical insurance coverage plans at any time throughout the year.